when are property taxes due in will county illinois

Welcome to the web page of the Christian County Treasurer. 407 N Monroe Marion IL 62959 Phone.

Cook County Property Owner Tax Bill Payments Extended Until October 1st West Suburban Journal

Tax Year 2021 Second Installment Property Tax Due Date.

. DeKalb County Government 200 North Main Street Sycamore Illinois 60178. In Will County property taxes are due on June 1st and September 1st of each year. The county said second installment bills will come before the end of the year.

Welcome to Property Taxes and Fees. Are Illinois property taxes extended. The Tax Collectors Public Service Office located.

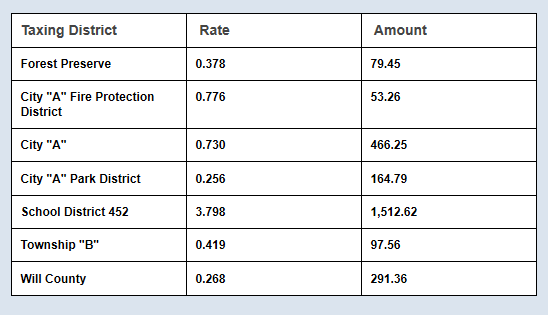

Joliet IL 60432 If you prefer to pay in person you can do so at the Will County Treasurers Office. Illinois Property Taxes Go To Different State 350700 Avg. Consolidation efforts are centered around partnerships that will enhance efficiency accountability and cost savings.

Mail your payment to. Miami-Dade County is hiring. Will County Treasurer 302 N.

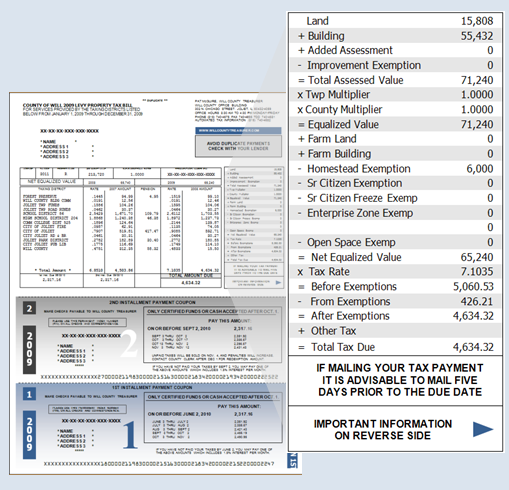

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. 2019 payable 2020 tax bills are.

Chicago Street Joliet IL 60432. In most counties property taxes are paid in two installments usually June 1 and September 1. The first installment of property tax bills in 2023 is expected to be due March 1.

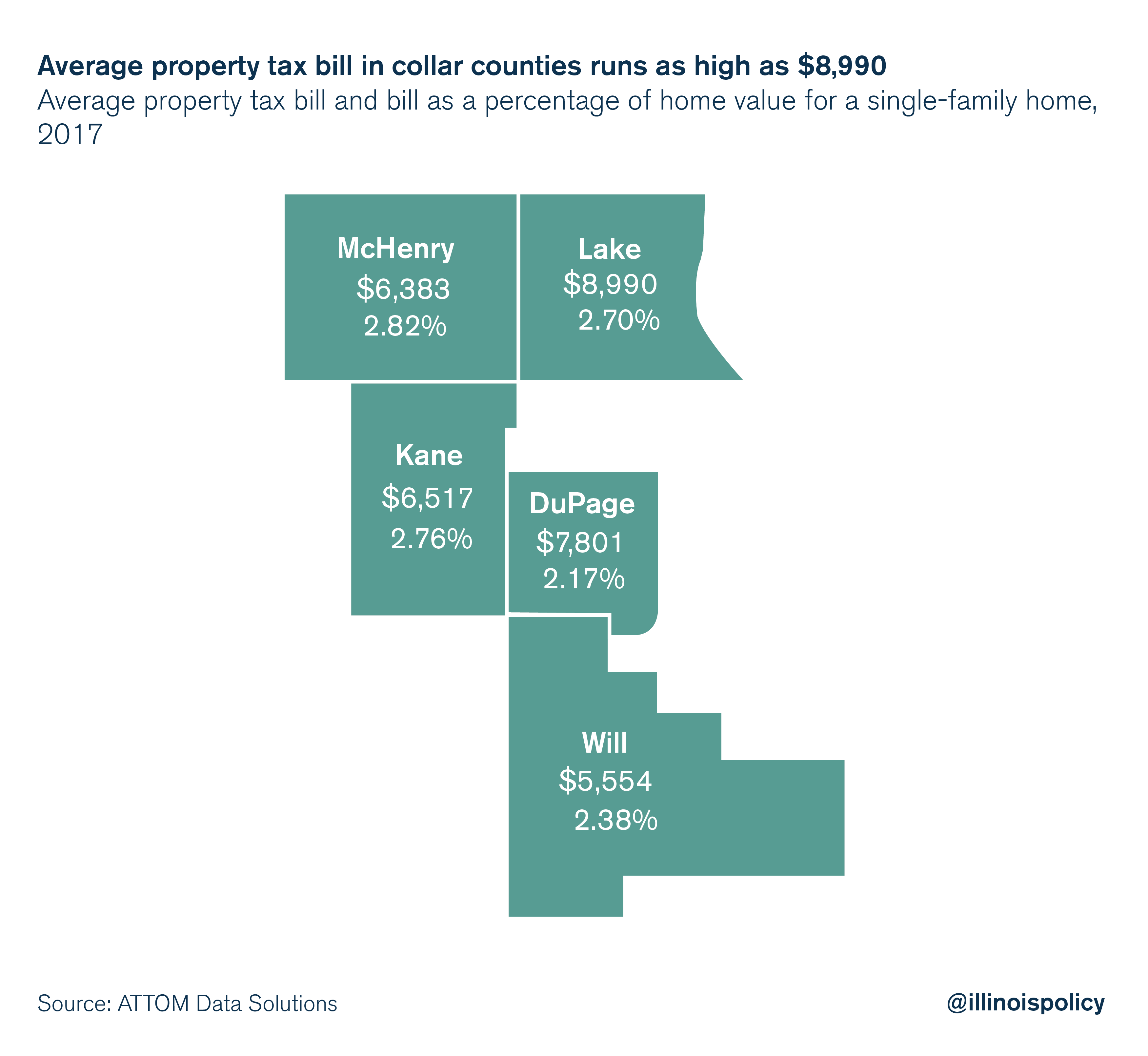

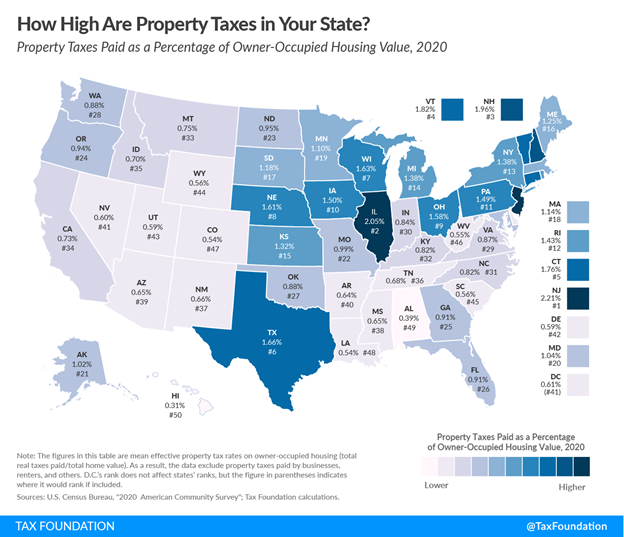

100s of Top Rated Local Professionals Waiting to Help You Today. Odds are growing that the due date on 16 billion in Cook County property tax bills will be Dec. Illinois was home to the nations second-highest property taxes in 2021.

173 of home value Tax amount varies by county The median property tax in Illinois is 350700 per year for a home worth the. The mailing of the bills is dependent on the completion of data by other local. Sun Mon Tue Wed Thu Fri Sat.

Ad Get In-Depth Property Tax Data In Minutes. 1 2023 with a taxpayer savings of 70 million. Start Your Homeowner Search Today.

205 of home value Yearly median tax in Will County The median property tax in Will County Illinois is 4921 per. 2 nd Installment due September 1 2022 with the interest to begin. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section.

Property Tax Help Click Here. Then just a few months later the first installment of 2023 will be due. Foreclosure Help Click Here.

Welcome to Property Taxes and Fees. Has yet to be determined. Subsequent taxes will only be accepted in office.

If you have a mortgage your lender will likely pay your property taxes for you and escrow the. M-F 800am - 400pm. Search for available job openings.

2022 Annual Tax Bills are scheduled to be mailed on Monday Oct. Such As Deeds Liens Property Tax More. Will County Illinois Property Tax Go To Different County 492100 Avg.

Search Valuable Data On A Property. Other Ways to Pay. 101 South Main Street.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. Learn how the County Board has kept the tax levy flat for.

150 Lockport Il Ideas Lockport Lockport Illinois Illinois

County Treasurer Williamson County Illinois

The Will County Circuit Court Clerk Andrea Lynn Chasteen Home

Property Taxes By County Interactive Map Tax Foundation

Cook County Treasurer S Office Chicago Illinois

Analysis Willowbrook Pays Property Taxes Nearly Three Times National Average Will County Gazette

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Report Kendall County Property Tax Rates More Than Double The National Average

Reboot Illinois Which Illinois Counties Have The Highest Average Home Prices And Property Taxes Property Tax County House Prices

Dupage County Il County Board District Map

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Property Tax Burden In The Chicago Region Cmap

New Report Illinois Property Taxes Among Highest In Nation The Civic Federation

Cook County 2022 Property Tax Bills Will Be Due By End Of Year Crain S Chicago Business

Analysis New Lenox Pays Property Taxes Two Times National Average Will County Gazette